How longevity impacts DB plans and financial wellness

People are living longer than at any other time in history. But what does that mean for defined benefit (DB) plan sponsors? Are there ways to help bolster the financial wellness of employees who might spend decades in retirement? And are sponsors prepared for the impact of longevity: its effect on their plan's financial wellness? PLANSPONSOR discussed these questions with Russ Proctor and Marty Menin, both Directors of Institutional Sales at Pacific Life Insurance Company, to determine what plan sponsors should know about the impact of longevity.

PS: How long are people living today?

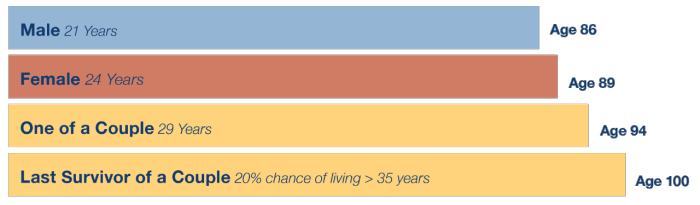

Proctor: When the subject is retirement planning, the real question is how long do people think they're going to live? I hear people approaching retirement who say they expect to live to age 76 because they remember hearing that's the age of life expectancy. However, that number is a little out of date and—more importantly—that's from birth. Once you reach age 65, the Society of Actuaries' mortality tables show that males are typically living to age 86 and females to age 89.

Menin: Especially for married couples; there's a 50/50 chance that one spouse will live to age 94, and a 20% chance one of them will live to 100. Thirty to 35 years of retirement planning is a long time to plan for and to be certain that your money will last.

PS: Does longevity differ by demographics?

Menin: There are different ways to look at demographics, aside from the most obvious male versus female. The Society of Actuaries' (SOA) mortality tables have begun to break out things like blue collar versus white collar. Where individuals live, their education, and their income are also factors that affect longevity. From a DB plan sponsor perspective, they may have different populations covered by the pension plan—such as manufacturing and research divisions in which workers have different educational or income backgrounds—and they need to consider those to determine what the true longevity risk is for their pension plan.

Proctor: From the plan sponsor's point of view, the difference between white collar and blue collar employees affects their pension plan and how long benefit payments will be made. If you have a highly-educated, highly-paid white collar workforce, your risk may be much higher in terms of having to pay those benefits for a longer period of time and that will affect the plan's financial wellness going forward.

PS: How does this impact qualified pension plans?