Given current events and the economic uncertainty facing retirees, it might be beneficial for those nearing retirement age to consider guaranteed lifetime income. The Setting Every Community Up for Retirement Enhancement (SECURE) Act was recently signed into law. It modifies several areas of current retirement rules and includes changes affecting defined contribution (DC) plans that will make it easier for plan sponsors to add a lifetime income option to their DC plans. Providing a lifetime income option through a 401(k) plan may be attractive to plan participants due to potentially lower expenses and lower commissions. In addition, institutional or group pricing combined with unisex rates may be a particularly good benefit for women who elect to annuitize all or part of their account balances through their employers' 401(k) plans.

More Lifetime Income

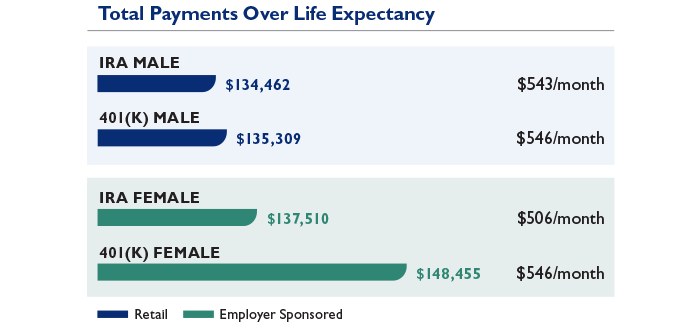

Typically, lifetime income strategies provided at work through a 401(k) plan must use unisex pricing. This requirement means that women gain a pricing edge when purchasing lifetime income at work versus the retail marketplace. For example, if a participant rolled his/her DC account balance to an IRA and purchased lifetime income in the retail market, a woman would receive a slightly lower monthly benefit than a man at the same age. This result is simply because women generally live longer than men, and insurance companies take that into account when determining the monthly payment. However, in an employer-sponsored retirement plan, the insurance company providing the lifetime income solution must use the same annuity rates for both men and women, resulting in a positive outcome for women. In other words, if annuitizing a portion of their 401(k) balance makes financial sense given their retirement needs, then women win at work.

The illustration at the top shows the expected differences between a male and a female annuity result at age 65. Note that in this example, both the male and female receive higher monthly benefits from an annuity purchased from a 401(k) plan due to no commission assumed on the 401(k) annuity. In addition, the female receives significantly more in total expected payments by about $11,000 due in large part to unisex pricing and her longer life expectancy. This is a valuable benefit to consider making available to employees of your organization.

Prior to the SECURE Act, few plans offered a lifetime income option. The SECURE Act helps resolve several of the key elements that have prevented plan sponsors from adding a lifetime income option to their 401(k) plans.

Fiduciary Safe Harbor

Plan fiduciaries have been requesting additional safe harbor guidance on selecting a lifetime income provider for years. Defined contribution plan sponsors were concerned that they would be held liable if an insurance company looked solvent at the time of selection but later failed. The SECURE Act provides new guidance on key factors that must be considered by plan sponsors and plan fiduciaries at the time a provider is selected. If these guidelines are followed, the plan fiduciary will not be liable for failure of the insurance company in the future.