How DB pension plan sponsors can reduce variable-rate PBGC premiums

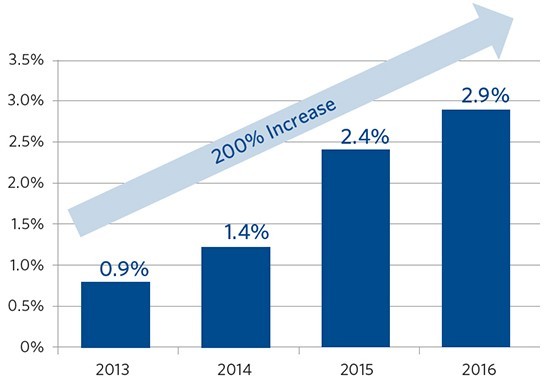

In 2014, variable-rate Pension Benefit Guaranty Corporation (PBGC) premiums were 1.4% of the plan's unfunded vested benefits, but rates will increase to 2.4% this year and to 2.9% in 2016. Many plan sponsors of defined benefit (DB) pension plans may not be aware of these increases and may be caught off-guard come October, when the 2015 PBGC premiums are due. However, they can take action now to reduce or eliminate the variable-rate premium. Pacific Life's Russ Proctor and Marty Menin spoke to PLANSPONSOR about a possible solution for sponsors of DB pension plans—a solution that can help stabilize their funded status should they decide to make a larger pension contribution in 2015 and reduce their variable-rate PBGC premium.

PS: The increase in the variable-rate PBGC premiums has been large. How can a plan sponsor address this issue?

Menin: That increase is certainly significant. In fact, if you look back at 2013, the variable-rate premium was just 0.9% of the unfunded vested benefit amount. This means that the variable rate PBGC premiums will have actually tripled in just three years, going from 0.9% in 2013 to what will be 2.9% next year. There is a relatively easy answer: Plan sponsors can increase their contributions to their pension plan and reduce that unfunded amount, but that's not necessarily an easy thing for all plan sponsors to do.

PS: So, what do DB plan sponsors do? How do they start to address this?

Menin: If plan sponsors do not have the cash available to fund the shortfall, they could consider borrowing the money. After all, the unfunded pension liability is effectively already just debt owed to the pension plan, so they would be replacing variable pension debt with fixed debt.

Let's say you could borrow money at 6% interest and contribute that to the pension plan to eliminate the PBGC variable premium. Although you are paying 6% interest on the loan, you are saving almost 3% in PBGC premiums. Thus, the net cost of borrowing is reduced by about half. For some plan sponsors, the cost of borrowing might even be lower in this low interest-rate environment.

PS: Isn't there still a lot of risk for the plan sponsor? How do they prevent the plan from becoming underfunded again due to interest-rate or investment volatility?

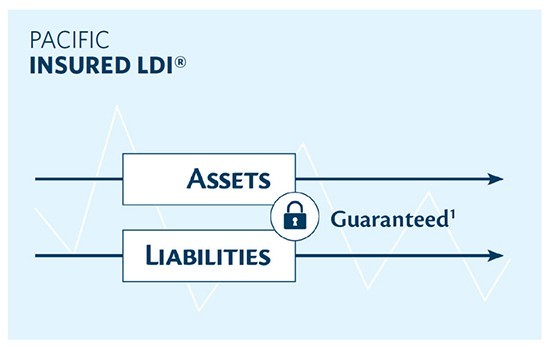

Proctor: That's a great point. The volatility risk may actually be greater now that the plan is fully funded. The plan sponsor is going to see more variance in that funded status now that there are more assets in the plan. And, after plan sponsors have funded up their plan and avoided those PBGC premiums, the last thing they want is to be underfunded again. Yet, that can easily happen if the assets remain allocated 60% equity and 40% fixed, where they're subject to all the fluctuations in the market.